Does your company need liquidity? If you are currently using an asset such as an office or a business premises, you may be able to achieve what you wish without having to ask for a bank loan. Read on to find out what sale and leaseback real estate is all about and when it is used.

What is sale and leaseback?

Companies often have assets and yet, at the same time, are in need for cash. They often turn to banks for financial support when a cash injection is required. However, a sale and leaseback agreement involves the company selling the property to a leasing company and then, immediately afterwards, signing a financial lease agreement for that property with the leasing agent for an extended period of time (often 10 or 15 years approximately), as in, they rent the building but maintain the right to buy it back.

With a sale and leaseback agreement the company that used to own the property stays put and becomes a tenant who has the right to buy.

What are the advantages of a sale and lease back?

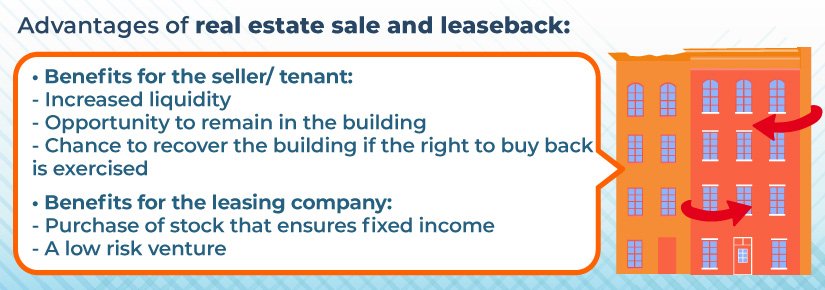

Companies that enter into sale and leaseback agreements on a property of their own obtain several benefits:

- They have more liquidity, given the fact that they have received monies from selling the property

- They can remain in the property, not as owners but as tenants, which means that they can continue operating without moving.

- They maintain the option of regaining ownership of the property if they exercise their right to buy it

A sale and leaseback option also benefits the leasing company that buys the property because it offers them increased profitability at low risk.

Outlines of a sale and leaseback contract

The sale and leaseback contract is complex and should be brokered by and overseenby a legal professional. Some of the details that you should bear in mind include:

- As the name suggests, a sale and leaseback contract includes two separate contracts: the sale purchase contract and the lease-to-buy contract.

- It is a transaction that offers financing to the original owner who then becomes a tenant, therefore, to ensure that the gain is net, all the costs involved in running the building are the responsibility of the tenant.

- The tenant is free to manage the building, including maintenance and building works. The only limit is on works that would diminish the value of the property.

- The duration of the rental contract tends to be rather lengthy, usually over a minimum period of 10 or 15 years.

- With regards to the duration of these contracts, it is worth noting that there are usually mandatory seven-year periods that are agreed upon when signing. This means that, by law, if the tenant pulls out of the contract prior to the completion of the mandatory period, they are obliged to pay the owner the equivalent of the remaining rental due.

- The contract includes a favourable repurchase clause for the seller, which is necessarily regulated in order to clearly state the time frame, procedure and price for the future sale purchase agreement.

- The object of the sale and leaseback agreement could be real estate (mostly premises, warehouses or offices) or chattels (movable property), although the latter is less common as the sale and leaseback on such items must be studied properly to see if it can be governed in a way that makes it permissible.

- The consequences for rental defaults are closely regulated, given the fact that the profitability of this operation for the purchaser lies in the rental income to be gained. Therefore, clauses such as termination for default are included in these agreements.

- The tenant must provide a series of guarantees such as a deposit or a bank guarantee, to ensure rent will be paid.

- On most occasions, the amount of rent paid is discounted from the final sale price if the buy back option is undertaken by the tenant, meaning that the tenant is due to pay only the residual price when buying back the property in the future.

- The operation is subject to VAT. On the one hand, if the sale purchase is between two taxpayers, it is deemed a transfer of goods and therefore VAT must be paid at the moment the sale purchase takes place, and, on the other hand, the nature of reimbursement contemplated in these kinds of financial arrangements is considered to be a financial service and therefore VAT is paid on the service at the same time as the rent is collected.

Bearing in mind the above, Leialta is aware that the success lies in that the tenant gains cash flow once more and can continues operating, allowing for the company to buy back the property at a later date.