The Digital Nomad Visa in Spain has become one of the most attractive options for foreign professionals who work online and wish to settle in Spain. Thanks to the 2023 Startups Law, this visa allows foreigners to live in Spain and work legally for international companies or clients, while also enjoying very competitive tax advantages. At Leialta, we explain how to apply for it and how to comply with all legal and tax requirements.

If applied for at a Consulate, the visa is valid for up to 1 year; if processed from Spain before the UGE-CE, the initial authorization is for 3 years, renewable. After 5 years of continuous residence, long-term residence can be applied for. This visa is intended for third-country nationals (non-EU/EEA) who work remotely using telematic means for companies based outside Spain.

In this article, we explain what the Digital Nomad Visa is, what requirements it entails, and how to apply for it step by step.

What is the Digital Nomad Visa in Spain and who is it for?

Index of contents

The digital nomad visa in Spain is a residence permit designed for non-resident foreign professionals who work remotely, either as freelancers or as employees of foreign companies.

Its aim is to attract international talent and encourage investment in the Spanish technology ecosystem. Unlike other residence permits, this visa allows you to live in Spain while working online for clients or companies located outside the country.

The initial duration of the visa is one year if applied for from outside Spain, or up to three years if applied for within the country, with the possibility of renewal for an additional two years. After five years of continuous residence, applicants are entitled to permanent residence.

Main requirements for applying for the Digital Nomad Visa in Spain

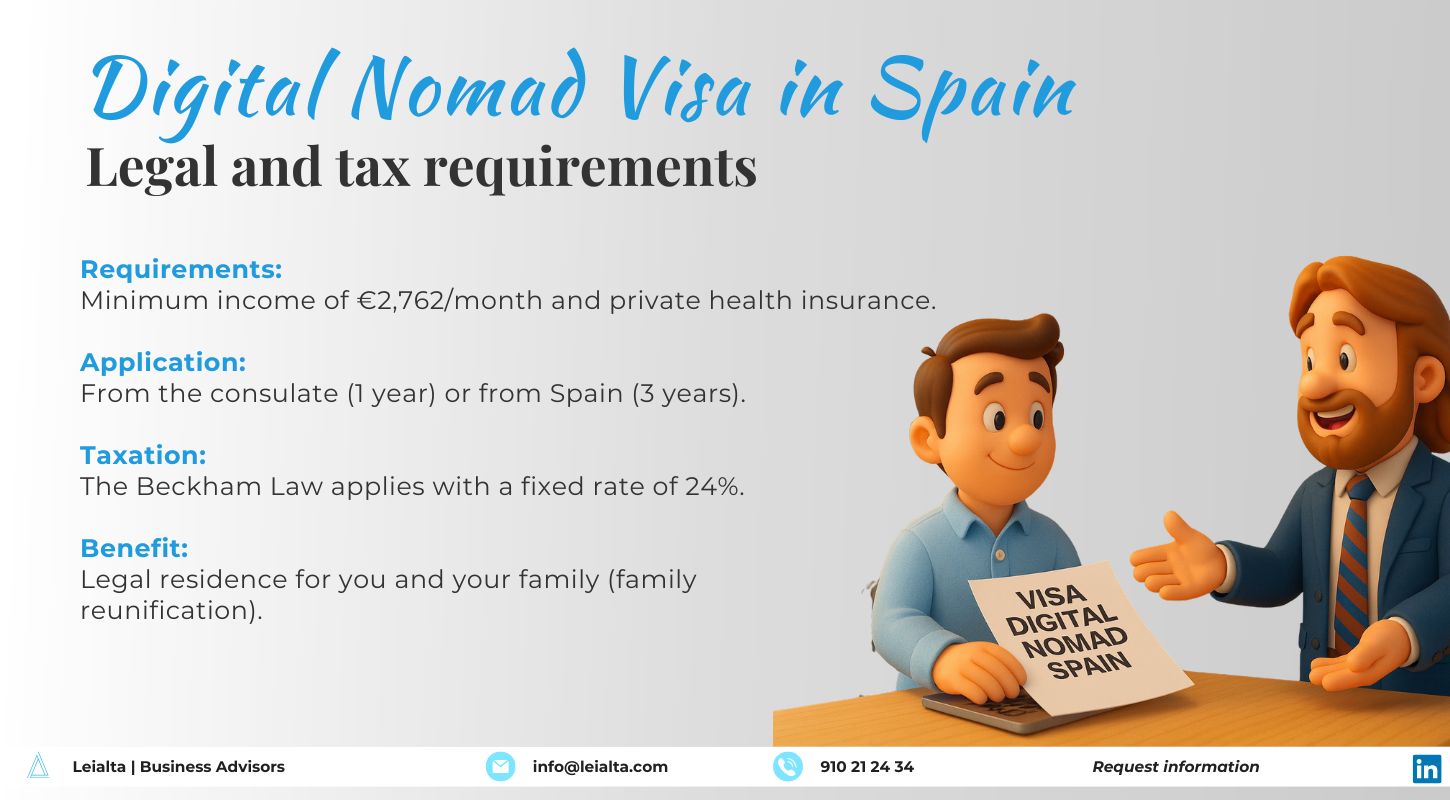

To apply for the digital nomad visa, applicants must meet several criteria established in the Startups Act:

- Be a non-EU citizen, i.e., not belong to the European Union or the European Economic Area.

- Demonstrate stable remote work, either through a contract with a foreign company or recurring international clients.

- Have at least three months of previous employment or professional relationship with said company or clients.

- Minimum income with a usual reference of 200% of the minimum wage. Specifically, in 2025, the minimum wage is €1,184/month in 14 payments (BOE RD 87/2025), so 200% is equivalent to €2,368/month in 14 payments (≈€2,762.66/month if prorated over 12 months).

- You must have private health insurance, a clean criminal record, and sufficient financial means to reside in the country.

- If you are self-employed: you must prove at least three months of previous professional relationship with the foreign company/client and that the company authorizes teleworking from Spain.

In short, you must prove a solid professional track record, be properly registered in your country of origin, and comply with applicable tax regulations.

How to apply for the Digital Nomad Visa step by step: consulate vs UGE-CE

The process of applying for the digital nomad visa varies slightly depending on where you are applying from.

Applying from abroad

If you are outside Spain, the application is submitted to the relevant Spanish Consulate in your country of residence. Once approved, you will obtain a one-year visa that allows you to enter and work legally from day one. After that, if you wish to continue in Spain, you must apply for a residence permit.

Application from Spain (if you are already residing temporarily)

If you are already in Spain legally (for example, on a short-term stay), you can apply for a three-year residence permit from the Large Companies Unit (UGE-CE). In this case, you will receive a three-year residence permit, which can be extended for a further two years.

In both cases, you must provide translated and legalized documentation, including:

- Translations and legalizations: foreign documentation must be duly translated and legalized/apostilled where applicable.

- Copy of your passport.

- Contract or agreement for the provision of services.

- Bank certificates proving your income.

- Health insurance policy.

- Certificate of criminal record.

Tax advantages for digital nomads: the appeal of the Beckham Law

Under the Special Tax Regime for Impats (Beckham Law), those who move to Spain can choose to be taxed under rules similar to those for non-residents during the year of the change and the following five years, if they meet the requirements (including not having been a tax resident in Spain in the previous five years).

This regime allows you to be taxed as a non-resident for the first six years, paying a fixed rate of 24% on income earned in Spain up to €600,000 per year, instead of the progressive income tax rates.

In short, under this regime, you pay tax in Spain on income earned in Spanish territory. In the case of salaries, what matters is where you physically work: if you work from Spain, your salary is considered to be earned in Spain and is taxed here (24% rate up to €600,000); however, days worked abroad can be treated as not earned in Spain if they are accredited.

Tax and labor obligations when working from Spain

Although the digital nomad visa simplifies legal residence, it also entails certain tax obligations:

- Correctly declare your situation to the Spanish Tax Agency, especially if you stay in the country for more than 183 days a year.

- Comply with Social Security regulations if you work part-time for Spanish companies.

- Maintain transparent accounting if you operate as a freelancer.

- Tax residence: if you stay in Spain for more than 183 days, you will generally be considered a tax resident (except under special circumstances), with the corresponding implications.

- Social Security: if you work exclusively for a foreign company, you must review your Social Security coverage and when you may be required to register/pay contributions in Spain.

Options for working legally: self-employment or setting up a company

One of the most common options is to operate as a freelancer (invoicing foreign clients) or, depending on the case, to maintain a foreign contract or set up a company in Spain.

In the case of freelancers, a limited percentage of activity for Spanish clients is permitted. In the case of employment profiles, the work must be carried out for companies based outside Spain.

Another option is to set up a company or subsidiary to channel your income and benefit from the advantages of the Startups Law, which offers reduced corporate tax and facilities for foreign investment.

In both cases, Leialta offers legal and tax advice according to your professional profile and your residence objectives.

Renewal, duration, and most common reasons for denial

If you enter with a consular visa: the visa allows you to reside and telework for up to one year and is not renewable. If you wish to continue in Spain, you must apply for a residence permit for international telework before it expires (without having to apply for another visa).

If you already have a UGE-CE authorization (applied for in Spain): the authorization is initially for 3 years and can be extended for 2 years if the requirements are met (remote work for a foreign company/client, income, insurance, etc.). After 5 years of continuous residence, you can apply for long-term residence.

Most common reasons for rejection

- Insufficient or poorly documented income. Incomplete or incorrectly legalized/translated documentation.

- Incompatibilities with international teleworking (e.g., activity that does not fit).

- Criminal record in the country of origin or in Spain.

Common mistakes when applying for the Digital Nomad Visa

Although the application process is relatively simple, many candidates make small mistakes that can delay or even lead to the denial of the Digital Nomad Visa in Spain. Among the most common are:

- Failure to properly prove minimum income or employment relationship with the foreign company.

- Submitting documentation that is not translated or legalized.

- Failure to take out valid medical insurance in Spanish territory.

- Confusing the visa with other residence permits or failing to meet renewal deadlines.

Family reunification: how to bring your partner or family with the Digital Nomad Visa

The Digital Nomad Visa in Spain is not only designed for professionals who want to work remotely from the country, but also for those who want to do so with their partner or family. This visa allows you to apply for family reunification, so that your loved ones can accompany you and reside legally with you for the entire duration of the permit.

Your spouse or common-law partner, your minor or dependent children, and even other family members who can prove financial dependence can benefit from reunification. To do so, you must demonstrate sufficient financial means to cover their expenses and provide documentation proving the family relationship (marriage certificate, registered partnership or birth certificate), duly translated and legalized.

Family members obtain a residence permit linked to the holder, with the possibility, in certain cases, of working in Spain on a self-employed or employed basis during its validity.

Before starting the process, it is advisable to verify the specific situation. Factors such as the type of contract, the paying country, the length of stay in Spain, the source of income, Social Security coverage, or whether you are traveling with family members may change the appropriate route (consular visa or UGE-CE authorization), the documentation, and the deadlines. A prior review avoids common mistakes (incorrectly accredited income, incomplete translations/legalizations, or confusion with the tax regime).

How Leialta can help you apply for the Digital Nomad Visa in Spain

At LEIALTA, we help international professionals, freelancers, and entrepreneurs to apply for the Digital Nomad Visa in Spain safely and efficiently, reducing risks and ensuring legal and tax compliance.

Through our legal, accounting, and tax advisory services, we ensure that all procedures are carried out correctly and that no problems arise with the relevant authorities, so that you can live and work in Spain with complete peace of mind