Did you know that if your company meets certain requirements, you can request a monthly VAT refund? For companies and self-employed workers in Spain, managing VAT is one of the most important tax obligations. Although self-assessments are usually submitted on a quarterly basis, there are mechanisms that allow you to recover input VAT more quickly, improving your business’s liquidity.

That is why, in this article, we explain how to request a VAT refund, the deadlines for the tax authorities to make refunds, and how to take advantage of the Monthly Refund Scheme (REDEME).

What is a VAT refund and when can it be requested?

Index of contents

A VAT refund is the right of business owners and self-employed workers to recover VAT payments that exceed the VAT charged during a settlement period. In other words, if you have paid more VAT on your purchases and expenses than you have charged your customers, you can request a refund of the difference from the tax authorities.

This can occur regularly in sectors with high investment, such as companies that purchase machinery or real estate, or in businesses that work with reduced or exempt VAT rates, such as exporters or intra-Community service companies.

How long does it take for the Tax Agency to refund VAT? Deadlines and examples

One of the issues that most concerns business owners and self-employed workers is how long it takes for the tax authorities to refund VAT.

The tax authorities have a maximum period of six months to refund VAT. This period begins on the date of submission of the self-assessment form in which the refund was requested (or from the date of submission, if it was submitted after the deadline). If those six months elapse without payment being ordered, the Tax Agency must also pay interest for late payment, provided that the delay is not due to causes attributable to the taxpayer. This deadline applies to both companies and self-employed workers who request a VAT refund, provided that they meet the established requirements.

Types of VAT refund: annual or monthly

There are two types of refund: annual or monthly. In the case of an annual refund, if Form 303 is filed quarterly, the refund is normally requested in the last self-assessment of the year and the Tax Agency has six months (until June 30 of the following year) to pay.

On the other hand, with monthly refunds (REDEME), if you are registered for the monthly VAT refund scheme, you file form 303 every month and can obtain a refund every month.

To illustrate this better, here is an example: If in March the input VAT is €15,000 and the output VAT is only €7,000, in April you can request a refund of the difference and not wait until the end of the year.

How to request a VAT refund step by step

Although the procedure is done online, it is best to follow a specific order to avoid errors and speed up the refund process.

Prepare the necessary documentation

Before submitting form 303 or 390, you must ensure that all documentation for invoices issued and received is correctly accounted for and matches your VAT records.

Documentation proving the existence of the company

The first time you apply for a refund, the tax authorities may require various documents. The first could be the deed of incorporation, in the case of companies, or registration in the business census using form 036. In addition to this, you may need to provide proof of registration in the corresponding VAT regime, the books of invoices issued and received, and choose between offsetting or requesting a refund.

Choosing between offsetting or requesting a VAT refund

Taxpayers can request a VAT refund or offset the balance in their favor in future returns. Choosing between requesting a VAT refund to offset or requesting a refund depends on the financial situation and liquidity needs of the company or self-employed person.

- Offset the balance in your favor in future periods, reducing the VAT to be paid in future returns.

- Request a refund if you prefer to get your money back. This option is usually recommended when the amount is high or the company needs liquidity.

Submit form 303 or 390

Next, if you file quarterly VAT returns, you must check the refund box on form 303 for the fourth quarter. On the other hand, if you file monthly VAT returns, you must request a refund on each form 303.

In both cases, you must also file form 390 for the annual summary (unless you are in SII).

Monthly VAT refund in Spain: how REDEME works

It is important to understand that REDEME is much more than just an alternative payment method: it is a strategic cash flow tool. It is designed for companies that pay more VAT than they collect and want to recover that money on a monthly basis, rather than waiting for the annual settlement.

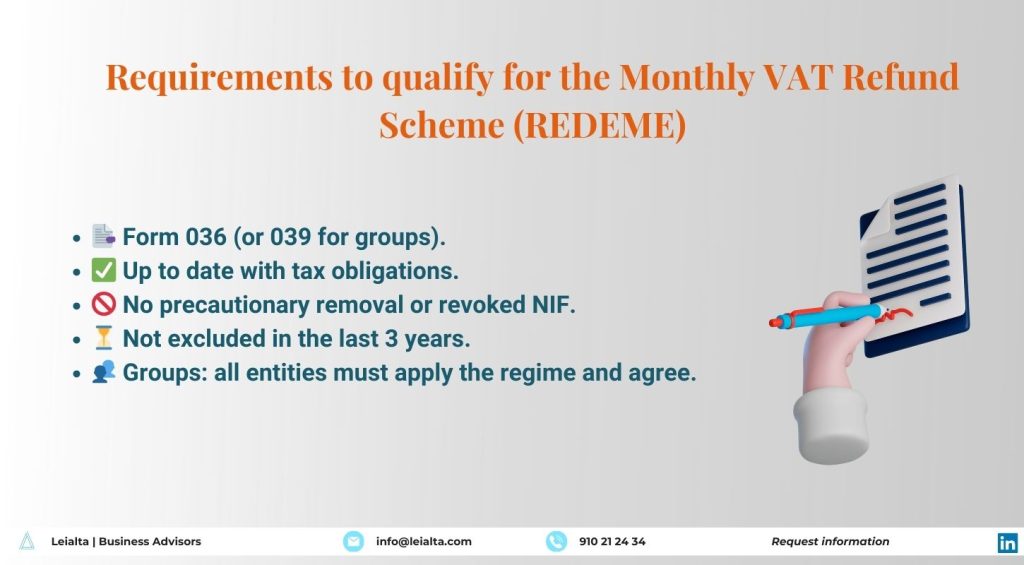

Requirements for REDEME eligibility

As in all cases, there are a number of requirements for eligibility for the scheme:

- Submit the application for registration using form 036 (or 039 for groups of entities).

- Be up to date with all tax obligations.

- Not be subject to precautionary deregistration or have your tax identification number revoked.

- Not have been excluded from the register in the previous three years.

- If you are a group of entities, all must apply the special scheme and formally agree to it.

- Be registered for Immediate Information Sharing (SII), i.e., keep VAT records electronically at the AEAT headquarters.

Deadlines and validity of registration in REDEME

If a company wishes to benefit from REDEME, it is essential to keep an eye on the deadlines, as outside of these periods it will be necessary to wait until the following financial year to apply for registration.

- The application must be submitted in November of the year prior to the one in which it is to be applied.

- It can also be requested during the current year: in this case, it takes effect from the month following the application.

- Registration is mandatory throughout the fiscal year, except in the case of voluntary withdrawal (also in November) or exclusion by the AEAT.

Reasons for exclusion from REDEME

Furthermore, the tax authorities may exclude you if you fail to meet basic requirements, such as submitting false information or not having VAT returns or records.

Exclusion takes effect from the first day of the settlement period in which it is notified and will prevent you from re-registering for three years.

VAT refund status: how to check it and what to do in case of delays

After submitting the form, you can check the status of your VAT refund on the Tax Agency’s website. The most common statuses are:

- Application received: the AEAT is reviewing the documentation.

- Under review: the data is being verified, and additional information may be requested.

- Payment in progress: the refund has been approved, and the payment has been ordered.

- Refund issued: the amount has already been transferred to the specified account.

You can check the status of your VAT refund at any time on the Tax Agency’s website. Through this online service, you can check your pending VAT refund, see if there are any issues, and check the status of the process.

In this case, if any delays (more than 6 months from the filing deadline) or incidents are detected, you can submit a written request for payment or contact your advisor to handle it.

In short, applying for a VAT refund correctly can significantly improve your company’s liquidity. If you also register with REDEME, you can receive refunds on a monthly basis and gain financial flexibility.

At LEIALTA, our tax experts analyze whether you meet the requirements, submit applications, and handle any issues with the Tax Agency so that you can get your money back as quickly as possible.