The reality is that starting a business in Spain as a foreigner is a real possibility and increasingly common, but to do so with guarantees, it is essential to know the applicable regulations and the options available. One of the most commonly used formulas is the sole proprietorship, i.e., working as a self-employed person, as it allows you to start your business quickly and easily.

However, it is not enough to have a business idea: you need to analyse the differences with a limited company, understand the legal requirements for non-residents and be aware of the tax implications of this type of business.

In this article, we will explore what a sole proprietorship is in Spain, the requirements for foreigners, and the advantages and disadvantages of being self-employed.

What is a Sole Proprietorship in Spain?

Index of contents

It is necessary to have a good understanding of sole proprietorships, also known as self-employment, which is the simplest way to start a business in Spain. This refers to a natural person who carries out an economic activity independently, without the need to set up a commercial company.

In this model, the entrepreneur is personally liable for any debts arising from their activity. This means that any obligation incurred by the company can directly affect their personal assets, although it also implies more agile management and less administrative burden than other models such as a limited company.

In short, for foreigners interested in entrepreneurship, a sole proprietorship in Spain is an accessible way to start operating, validate a business idea and develop a professional activity.

Differences Between a Sole Proprietorship and an SL

Once you have considered how to set up a business in Spain as a foreigner, it is worth analysing the differences between being self-employed and setting up a limited company (SL):

- Liability: the self-employed person is liable with all their assets, while in an SL liability is limited to the capital contributed.

- Initial capital: no minimum investment is required to register as self-employed; in an SL, a minimum share capital of €3,000 is required.

- Administrative management: the self-employed have simpler accounting and tax obligations; companies must keep commercial accounts and file annual accounts.

- Taxation: the self-employed pay income tax, which can be progressive depending on income; the SL pays corporation tax (25%).

- Image and growth: an SL can convey greater confidence to customers, suppliers or investors and facilitates external financing.

The choice will depend on the type of project, the investment capacity and the risk that the entrepreneur is willing to take.

Can foreigners set up a sole proprietorship (self-employed) in Spain?

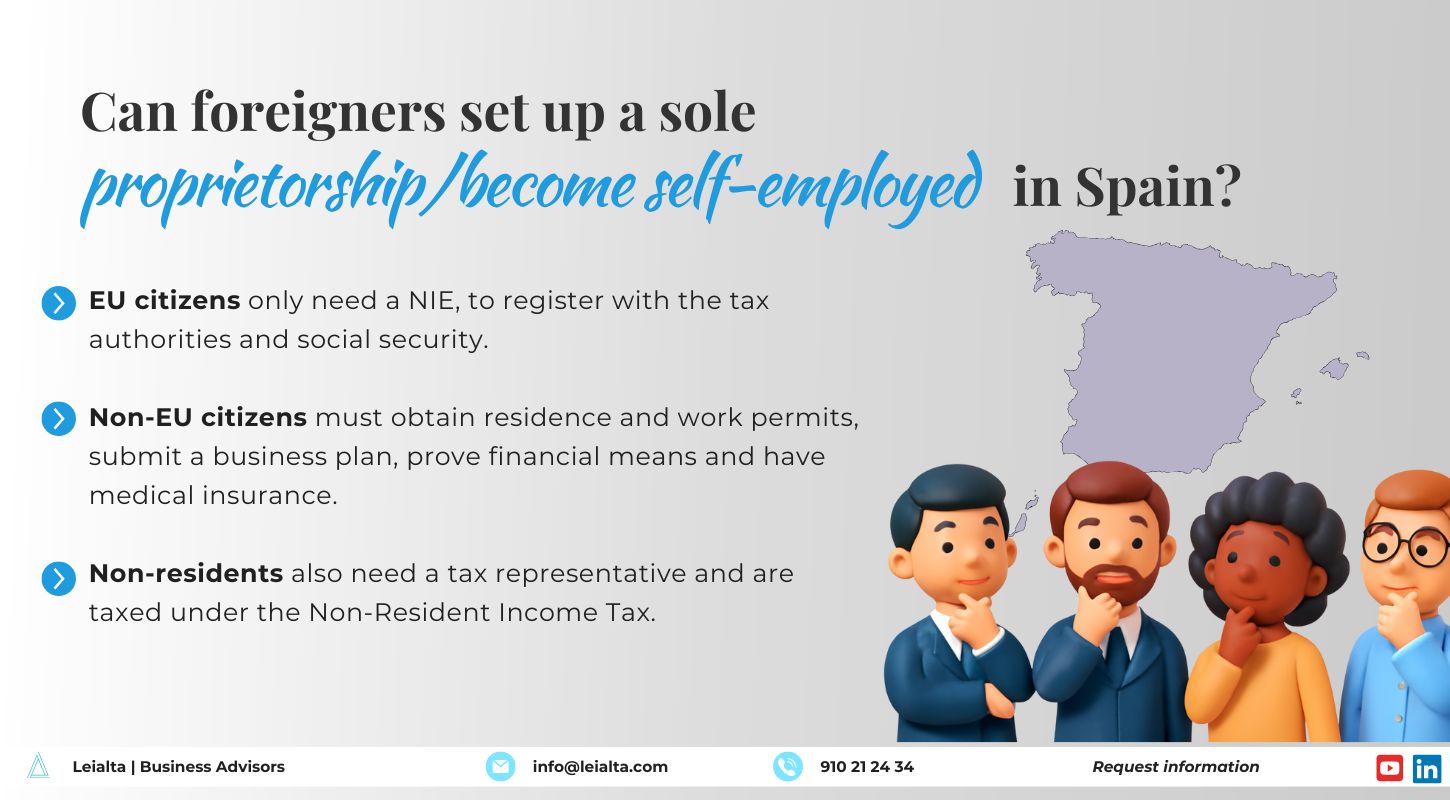

Both EU citizens and non-EU citizens can set up a business in Spain as foreigners, although there are certain nuances depending on their legal status and residence.

EU citizens only need a NIE (Foreign Identification Number) and to register with the Tax Agency and Social Security as self-employed. Non-EU citizens, on the other hand, require a residence and self-employment permit, in addition to meeting additional requirements such as proving investment, a business plan and sufficient financial means.

If you do not reside in Spain, it will be essential to appoint a tax representative for non-residents to act as your liaison with the Tax Agency.

Requirements for EU and non-EU citizens to set up a sole proprietorship in Spain

Setting up a sole proprietorship in Spain as a foreigner requires meeting different requirements depending on nationality and residence. EU citizens only need a NIE, to register with the tax authorities and social security, while non-EU citizens must obtain residence and work permits, submit a business plan, prove financial means and have medical insurance. Non-residents also need a tax representative and are taxed under the Non-Resident Income Tax.

Advantages and disadvantages of being self-employed as a foreigner

As with everything, there are a number of advantages and disadvantages to being self-employed while working abroad. These are as follows:

Advantages:

- Quick and inexpensive incorporation procedures.

- No minimum capital required.

- Flexibility to start the business on your own.

- Less administrative and accounting burden.

Disadvantages:

- Unlimited liability for debts.

- Progressive income tax, which can be high depending on income.

- Less perception of solidity vis-à-vis third parties.

- Limitations on growth or attracting investment.

Requirements for registering as a sole trader

The truth is that, in order to register as a self-employed person in Spain as a foreigner, the usual steps are:

- Obtain a NIE (Foreign Identification Number).

- Register with the tax authorities using form 036 or 037 (census declaration).

- Register with the RETA (Special Scheme for Self-Employed Workers) of the Social Security.

- Apply for municipal licences or permits depending on the activity.

- Appoint a tax representative if you are a non-resident.

Completing these steps ensures that the activity can be carried out legally from the outset.

What taxes does a sole proprietorship pay in Spain?

To illustrate this better, foreign self-employed workers are subject to the following tax models, at least the most important ones:

- IRPF: taxation on profits obtained.

- VAT: quarterly declaration and settlement, if the activity is subject to this tax.

- Withholdings and payments on account: if staff are hired or professionals are paid.

- Social Security contributions: monthly contribution to the RETA.

- On the other hand, for non-residents, taxation is carried out through the IRNR, on income generated in Spain, and requires tax representation.

In this sense, starting a business as a foreigner in Spain involves coordinating various legal, tax and administrative procedures. At LEIALTA, we offer comprehensive advice so that you can assess whether it is better to be self-employed or a limited company, if you want to apply for a tax identification number (NIF), authorisations or whatever else is required.

In general, our team of specialists helps you manage everything so that you can achieve your goals. In other words, we help foreign entrepreneurs start their business in Spain safely and efficiently, complying with regulations and optimising tax and administrative management from day one.