VAT Form 303 is the self-assessment form for declaring VAT charged on invoices and VAT paid on deductible expenses. It is Spain’s standard periodic VAT return, similar to a VAT Return in the UK or other EU countries. It applies to most self-employed workers and companies and is normally filed quarterly or monthly, depending on the applicable regime. For most taxpayers, it is quarterly. However, for large companies, those registered with the SII (Immediate Supply of Information) or those who are part of the REDEME (Electronic Data Exchange Network), it is monthly.

Broadly speaking, its function is to determine whether an amount is payable to the tax authorities, whether there is a balance to be offset, or whether a refund should be requested. It is therefore one of the most important tax forms for businesses and professionals, as it covers all VAT-liable activity on a regular basis for the period and forms the basis for all other obligations related to this tax.

For this reason, below we offer a comprehensive, up-to-date, and practical guide to help you understand its importance.

What is VAT Form 303?

Index of contents

Form 303 is the return that reflects the VAT charged on sales and services invoiced to customers and the deductible VAT paid on expenses necessary for the business activity. The final settlement amount is calculated based on these two amounts.

It is mandatory to file this return for all periods in which the activity is registered, even if there has been no income or expenses in that quarter or month. In these cases, the return is simply filed without any transactions, but it is still necessary. If the activity is deregistered or the taxpayer changes regime, then the obligation to file may disappear.

The structure of this key Tax Agency form always revolves around the same principle: declaring the VAT accrued on transactions carried out and deducting the input VAT that meets the legal requirements. The correct relationship between these two components determines the final result of the self-assessment.

Who must file Form 303

The obligation to file Form 303 covers most economic activities carried out in Spain. It must be filed by:

- Self-employed workers subject to the general VAT regime, both under the normal and simplified direct assessment methods.

- Companies and corporations of any size or sector.

- Large companies, which must file it monthly due to their volume of operations.

- Joint property entities, civil partnerships, and other entities without legal personality that carry out transactions subject to VAT.

On the other hand, there are cases in which it is not filed, such as certain activities that are completely exempt from VAT or merchants included in the equivalence surcharge. However, a single transaction subject to the tax is sufficient for the obligation to reappear. Therefore, it is always advisable to review the applicable tax regime.

Who is not required to file Form 303?

Not all taxpayers are required to file VAT Form 303. In general, those who carry out activities that are completely exempt from VAT are excluded, provided that they do not carry out other transactions subject to tax.

Traders under the equivalence surcharge regime are also not required to file this form, as VAT is settled directly on purchases and not through periodic self-assessments. Likewise, when no transactions subject to VAT have been carried out in a given period and the census situation has been correctly reported, there may be no obligation to file, although this obligation reappears as soon as a transaction subject to tax is carried out.

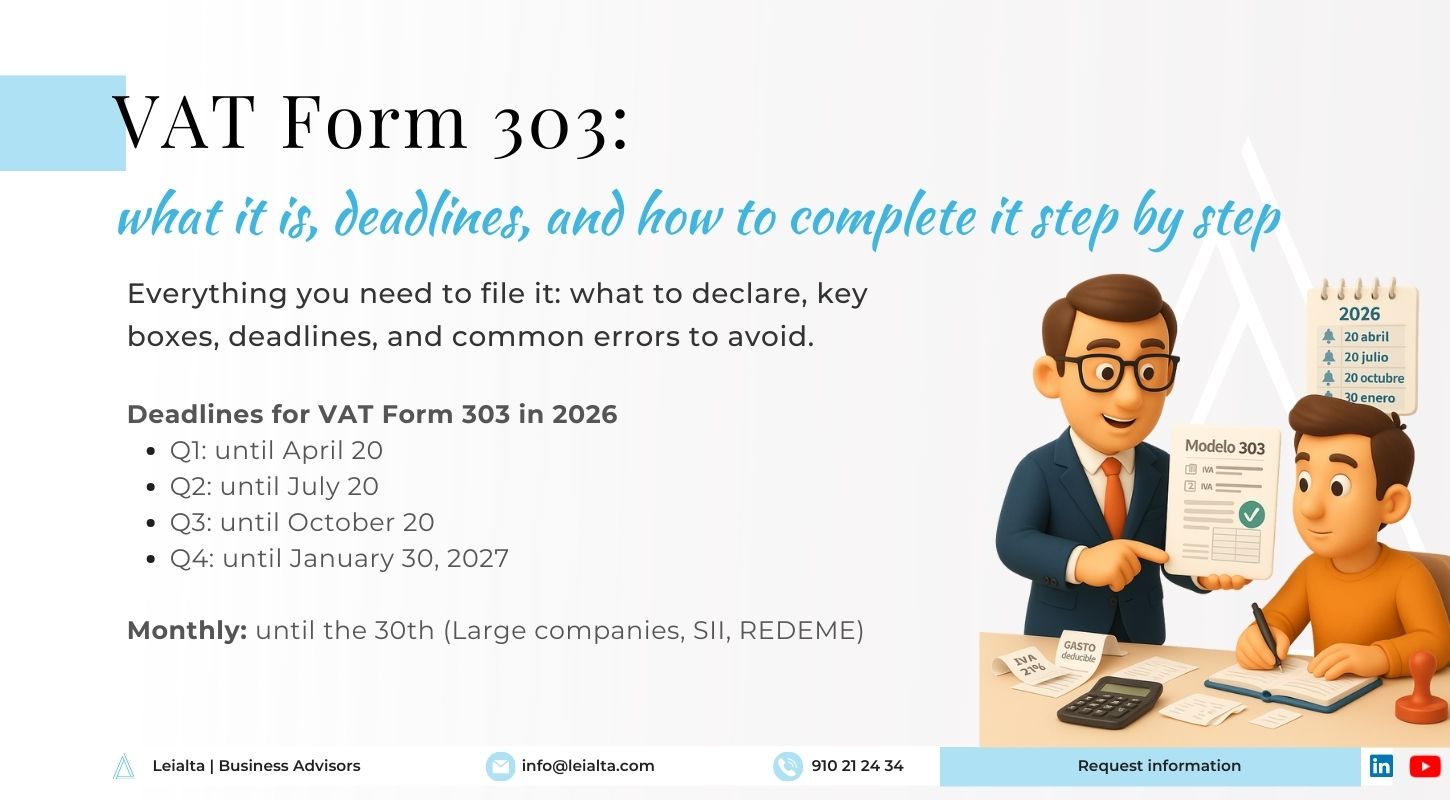

Deadlines for filing VAT Form 303 in Spain (2026)

The filing schedule for Form 303 depends on whether the settlement is quarterly or monthly. For 2026, the deadlines follow the usual schedule: the first quarter can be filed until April 20, the second until July 20, the third until October 20, and the fourth until January 30 of the following year. When the last day falls on a holiday or non-business day, the deadline is automatically moved to the next business day.

| Period | Filing Deadline | Type of Filing |

|---|---|---|

| 1st Quarter (January – March) | Until April 20, 2026 | Quarterly |

| 2nd Quarter (April – June) | Until July 20, 2026 | Quarterly |

| 3rd Quarter (July – September) | Until October 20, 2026 | Quarterly |

| 4th Quarter (October – December) | Until January 30, 2027 | Quarterly |

| Monthly filing | Until the 30th of the following month | Large companies, SII and REDEME |

In the case of monthly filings, the deadline is extended to the 30th day of the month following the reporting period. As mentioned above, this regime mainly affects large companies, those who work with Immediate Supply of Information (SII) and taxpayers registered in the Monthly VAT Refund Regime (REDEME).

If you need more details about the advantages, requirements, and process for registering for this regime, you can consult this content on REDEME.

How to fill out Form 303 step by step

As with all Tax Agency forms, the best way to understand, fill out, and submit it correctly is to have professionals who can offer us appropriate advice or manage it for us.

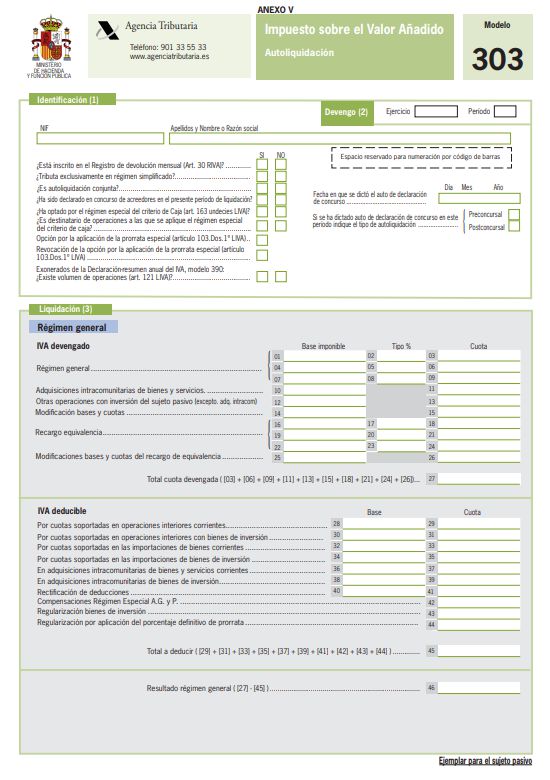

In any case, Form 303 follows a block order that is important to understand: The first block corresponds to VAT accrued, which includes all transactions subject to tax carried out during the period: sales, services, and invoices issued with any of the tax rates (21%, 10%, or 4%). Intra-Community acquisitions and transactions in which there is a reversal of the taxable person are also declared here, as well as modifications resulting from corrective invoices, refunds, or non-payments. Where applicable, the form also allows for the recording of equivalence surcharges. The sum of all these transactions determines the total amount accrued for the period.

The second section covers deductible input VAT, which includes VAT paid on purchases and expenses related to the activity. The form distinguishes between current expenses and capital goods, and also distinguishes between domestic transactions, intra-Community acquisitions, and imports. For an expense to be deductible, it must be directly related to the activity, have a complete invoice, and be correctly recorded in the VAT books. When the activity combines taxable and exempt transactions, or there is a pro rata, the form allows for adjustments to the deductions applied.

Within the return, box 110 is one of the most important, as it reflects the final result for the period: whether the self-assessment is to be paid, offset or, in certain cases, refunded. This box shows the difference between the VAT charged and the VAT deductible.

Finally, the form includes sections for exports and intra-Community transactions, which must be declared even if they do not generate amounts to be paid. Correct completion of these sections ensures that Form 303 matches other related forms, especially Form 349.

Pro rata and investment goods in Form 303

When an activity combines transactions subject to and exempt from VAT, the input VAT is not always fully deductible and it is necessary to apply the pro rata method, adjusting the deduction to the percentage of transactions subject to tax. This criterion affects both current expenses and investment goods, whose VAT may require adjustments in subsequent years if the degree of impact on the activity changes.

What happens when your VAT Form 303 result is negative

When the result of Form 303 is negative, it means that in that period the deductible input VAT exceeds the output VAT. This is a common situation, especially in the first months of activity or in periods with high investments or expenses.

Given this result, the taxpayer can choose between two alternatives:

- Leave the result to be offset, to be deducted in subsequent returns when VAT is generated for payment. This is the most common and simplest option in most cases.

- Request a VAT refund, an option that is generally reserved for the last return of the year or for those who are registered in the Monthly VAT Refund Scheme (REDEME).

The monthly refund scheme allows VAT to be recovered more quickly, although it involves greater formal control and more frequent reviews by the Tax Agency.

In practice, it is advisable to offset when the negative balance is temporary and VAT is expected to be generated in subsequent periods, while a refund is usually more appropriate when the negative result is recurrent or has a significant impact on the business’s liquidity.

How to file Form 303 online

Form 303 can only be filed electronically, through the Tax Agency’s website. To access the form, you must have a digital certificate, electronic ID card, or Cl@ve PIN, depending on the type of taxpayer.

Once you are in the system, the process consists of:

- Accessing the form for the corresponding period.

- Fill in the boxes.

- Validate and review the return.

- Submit it electronically.

If the result is a payment due, you can choose to pay by direct debit (until the deadline for doing so) or by making the payment using an NRC provided by the bank.

When you have finished, a PDF receipt is generated, which you should keep with the rest of your documentation for the financial year.

Common errors when filing Form 303

Errors in Form 303 usually arise from small details that go unnoticed and can lead to discrepancies, requests for additional information, or even penalties. Among the most common are:

- Incorrect deductions of input VAT, either because the invoice is incomplete, because it is not related to the activity, or because it has been incorrectly recorded in the VAT books.

- Declaring invoices in the wrong period, bearing in mind that VAT is declared according to the date of issue of the invoice and not according to the date of payment.

- Errors with corrective invoices, especially when they are not recorded in the corresponding quarter or the positive or negative adjustment is not correctly reflected.

- Problems with intra-Community transactions or reverse charge, especially when VAT is not correctly self-assessed or when it does not match the information on Form 349.

- Inconsistencies with other forms for the fiscal year, such as Form 347 or, where applicable, Form 390, which may trigger automatic checks by the tax authorities.

Overall, a final review of these points significantly reduces the risk of errors in each Form 303 return.

Relationship with Form 390

The relationship with Form 390 is direct, as this annual VAT summary must match exactly the information submitted on Forms 303 for the entire fiscal year. In other words, its function is to verify that the bases and amounts declared quarterly add up to the same as the annual total, avoiding discrepancies that could lead to additional requirements.

The difference between the two is that, while Form 303 requires periodic filing for VAT installment payments, Form 390 is an informative statement of the annual summary of those VAT settlement transactions. It should be noted that many companies no longer file Form 390 because the annual information is included in Form 303 for the fourth quarter or because they are covered by the Immediate Supply of Information (SII).

In addition, Form 390 includes data that is not detailed in each Form 303, such as:

- final pro rata.

- adjustments to investment goods.

Overall, Form 390 acts as the final VAT check for the year.

How Leialta helps you file VAT Form 303 in Spain

At Leialta, we work with freelancers, SMEs, subsidiaries, and business groups that need to file Form 303 for VAT securely and without errors. Our tax team reviews and classifies all transactions for the period, checks the deductibility of input VAT, and verifies that each invoice is correctly recorded in the VAT books and in the corresponding period.

If you need accounting and tax advice that is professional and efficient, write to us and we will be happy to analyze your case and send you a proposal, with no obligation.

Frequently asked questions about Form 303

What happens if I make a mistake on Form 303?

If you detect an error when submitting Form 303, it is possible to correct the return. Depending on the type of error and whether or not the result changes, you can submit a supplementary or replacement return. Acting as soon as possible usually avoids higher surcharges or possible penalties.

Can Form 303 be filed after the deadline?

Yes, Form 303 can be filed after the deadline, although doing so will result in surcharges or penalties, even when the result is to be offset or there is no activity. The amount will depend on the time elapsed and whether or not the Tax Agency has initiated a prior request.

What forms complement Form 303?

Form 303 is related to other VAT forms and certain informative returns. The most important is Form 390, which summarizes the information declared in the various Form 303s for the year. In intra-Community transactions, it is also related to Form 349, and in certain cases to Form 347.

How do you fill in Form 303 when there is no activity?

When there has been no income or expenditure in a given period, Form 303 must be submitted without activity, entering zeros in the corresponding boxes. As long as the activity is registered, submission is still mandatory, even if there are no transactions to declare.